Dong Lou

Director

HKUST Institute for Financial Research

Director, HKUST Institute for Financial Research

Associate Dean (Strategic Planning & Research), HKUST Business School

Dong Lou is a Chair Professor of Finance and Citi Professor of Business at the Hong Kong University of Science and Technology. He is also the Director of the HKUST Institute for Financial Research, an Associate Dean of the HKUST Business School, and the Director of the HKUST Bilingual DBA program. Prior to joining HKUST, He was a Professor of Finance at the London School of Economics.

Professor Lou is a Research Fellow at the Centre for Economic Policy Research, a Senior Fellow at the Asian Bureau of Finance and Economic Research, and an Academic Consultant and Visitor to the Bank of England. He is a recipient of the Distinguished Young Scholars (DYS) Scheme of the National Natural Science Foundation of China. He serves as an Associate Editor of the Journal of Finance, Journal of Financial Economics, and Management Science.

Professor Lou frequently advises government organizations and regularly consults for investment management companies. His research has been published in top academic journals, has won many awards, and is frequently profiled in financial media outlets including the Wall Street Journal, Forbes, and Bloomberg. His main research areas include asset pricing, investment management, behavioral finance, and the Chinese financial markets. Professor Lou received a PhD in Finance from Yale University and an undergraduate degree in Computer Science from Columbia University.

Publications

1.A Flow-Based Explanation for Return Predictability, 2012

Review of Financial Studies, 25, 3457-3489

Lead Article

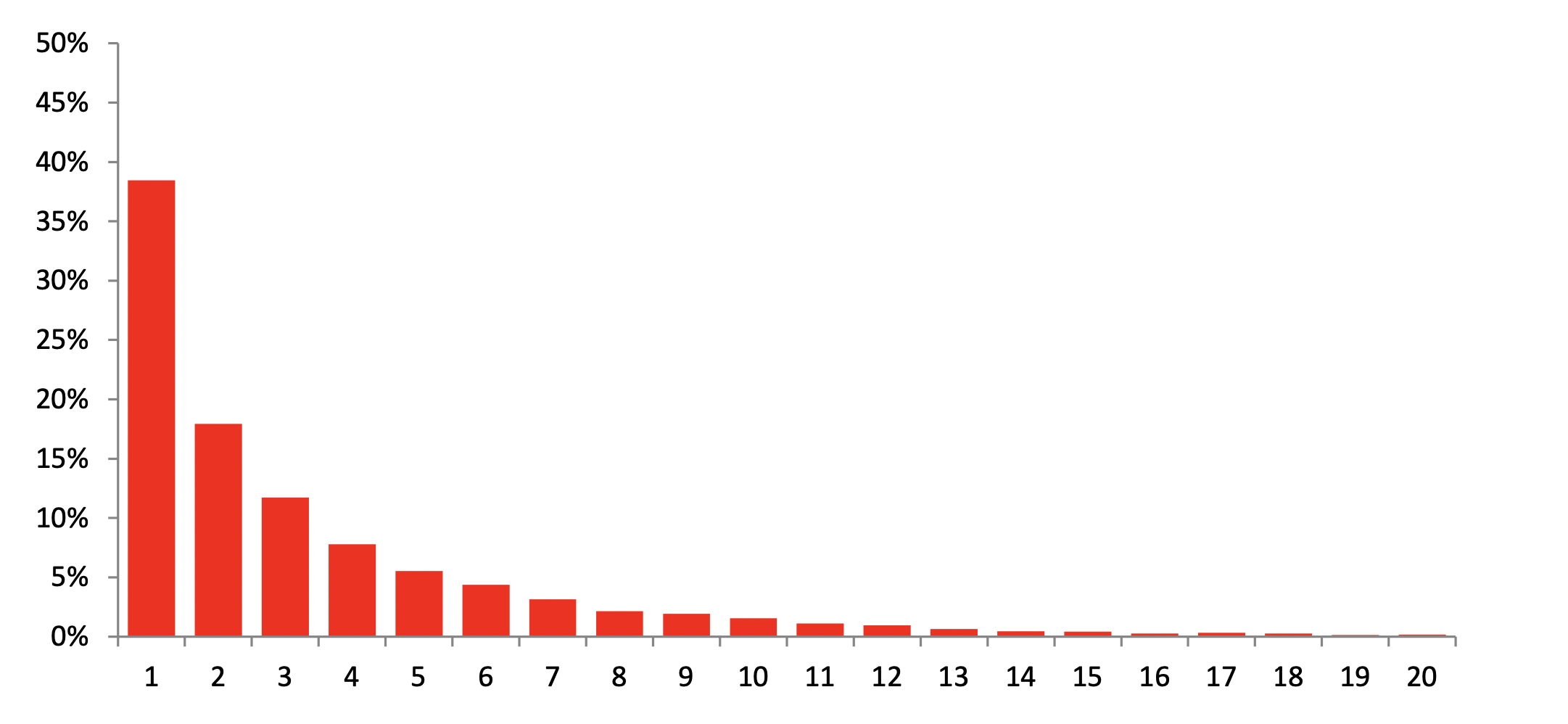

2.Complicated Firms (with Lauren Cohen), 2012

Journal of Financial Economics, 104, 383-400

Winner of First Prize, Crowell Memorial Award for Best Paper in Quantitative Investments, 2011

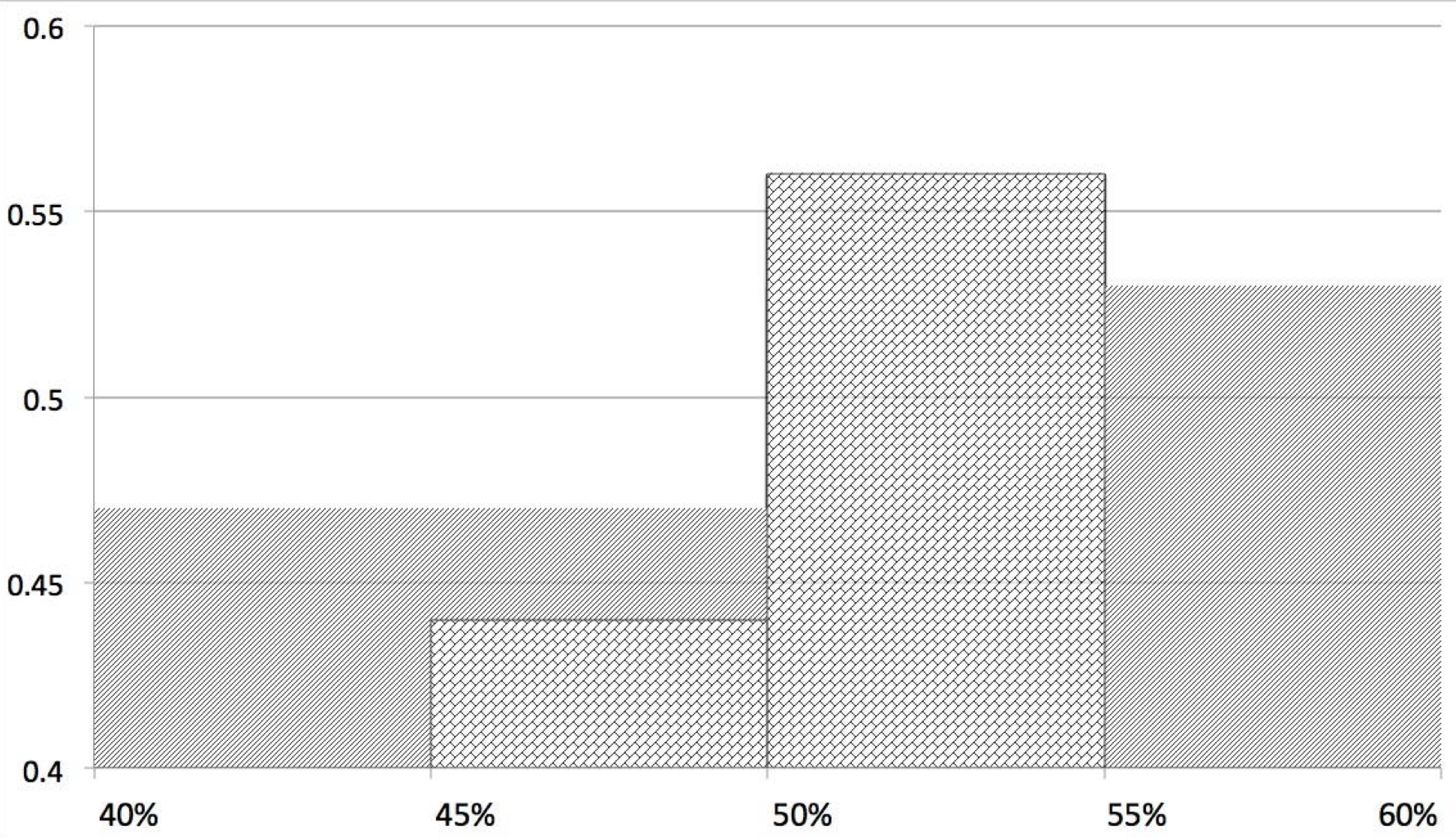

Winner of Best Paper Prize, the Center for Research in Security Prices (CRSP) Forum, 2010

Winner of Institute for Quantitative Investment Research (INQUIRE UK) Grant, 2010

Winner of First Prize, Istanbul Stock Exchange 25th Anniversary Best Paper Competition, 2010

Winner of Paul Woolley Center (UTS) Academic Grant, 2010

3.Anticipated and Repeated Shocks in Liquid Markets (with Hongjun Yan and Jinfan Zhang), 2013

Review of Financial Studies, 26, 1891-1912

Winner of NASDAQ OMX Award for Best Paper on Asset Pricing, Western Finance Association, 2011

4.Attracting Investor Attention through Advertising, 2014

Review of Financial Studies, 27, 1797-1829

5.Industry Window Dressing (with Huaizhi Chen and Lauren Cohen), 2016

Review of Financial Studies, 29, 3354-3393

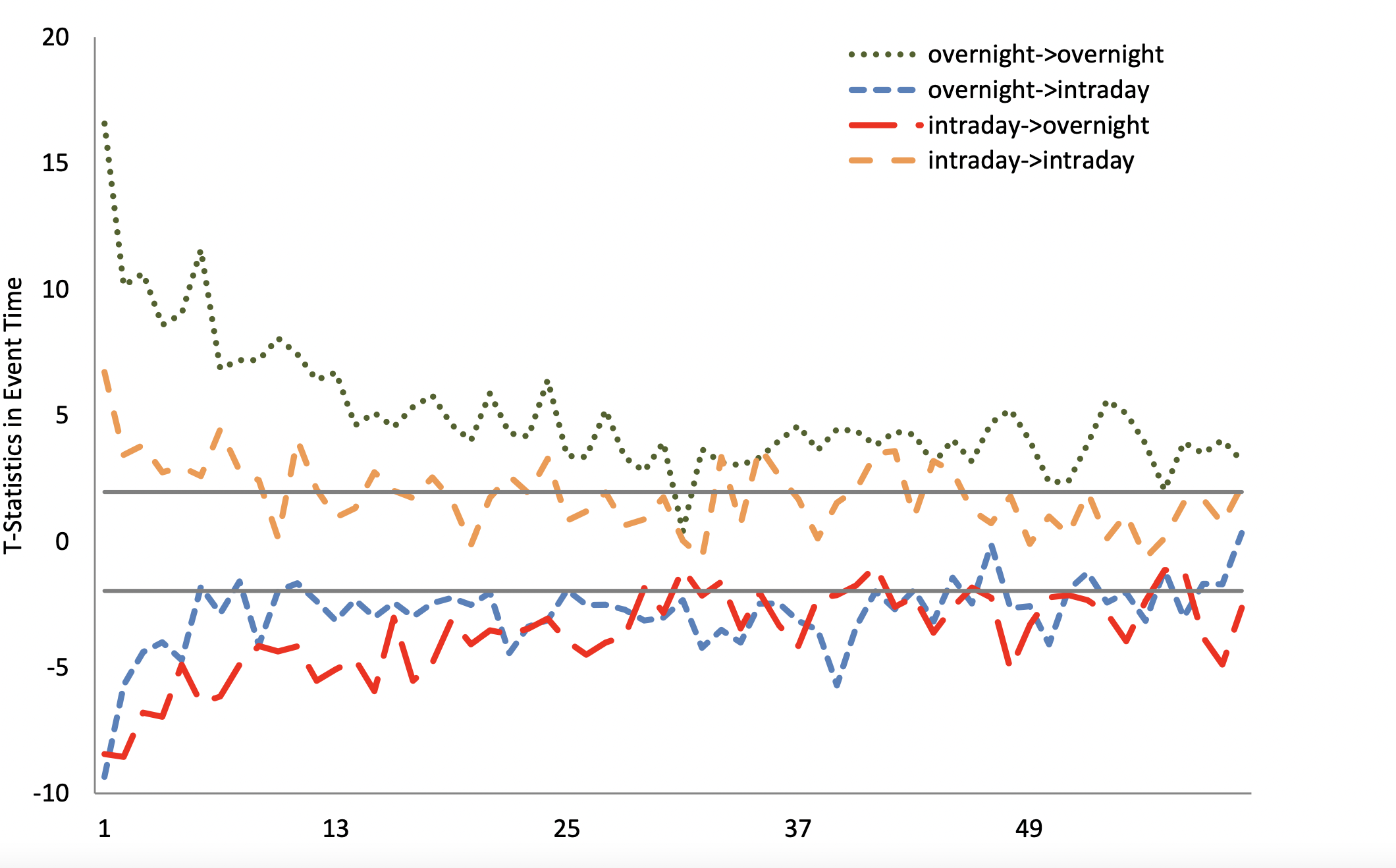

6.A Tug of War: Overnight vs. Intraday Expected Returns (with Christopher Polk and Spyros Skouras), 2019

Journal of Financial Economics, 134, 192-213 (Internet Appendix)

7.Offsetting Disagreement and Security Prices (with Shiyang Huang, Byoung-Hyoun Hwang, and Chengxi Yin), 2020

Management Science, 66, 3295-3798

8.IQ from IP: Simplifying Search in Portfolio Choice (with Huaizhi Chen, Lauren Cohen, Umit Gurun, and Christopher Malloy), 2020

Journal of Financial Economics, 138, 118-137

Winner of First Prize, Crowell Memorial Award for Best Paper in Quantitative Investments, 2018

9.Casting Conference Calls (with Lauren Cohen and Christopher Malloy), 2020

Management Science, 66, 4921-5484 (Internet Appendix)

Winner of First Prize, Crowell Memorial Award for Best Paper in Quantitative Investments, 2014

10.The Rate of Communication (with Shiyang Huang and Byoung-Hyoun Hwang), 2021

Journal of Financial Economics, 141, 533-550

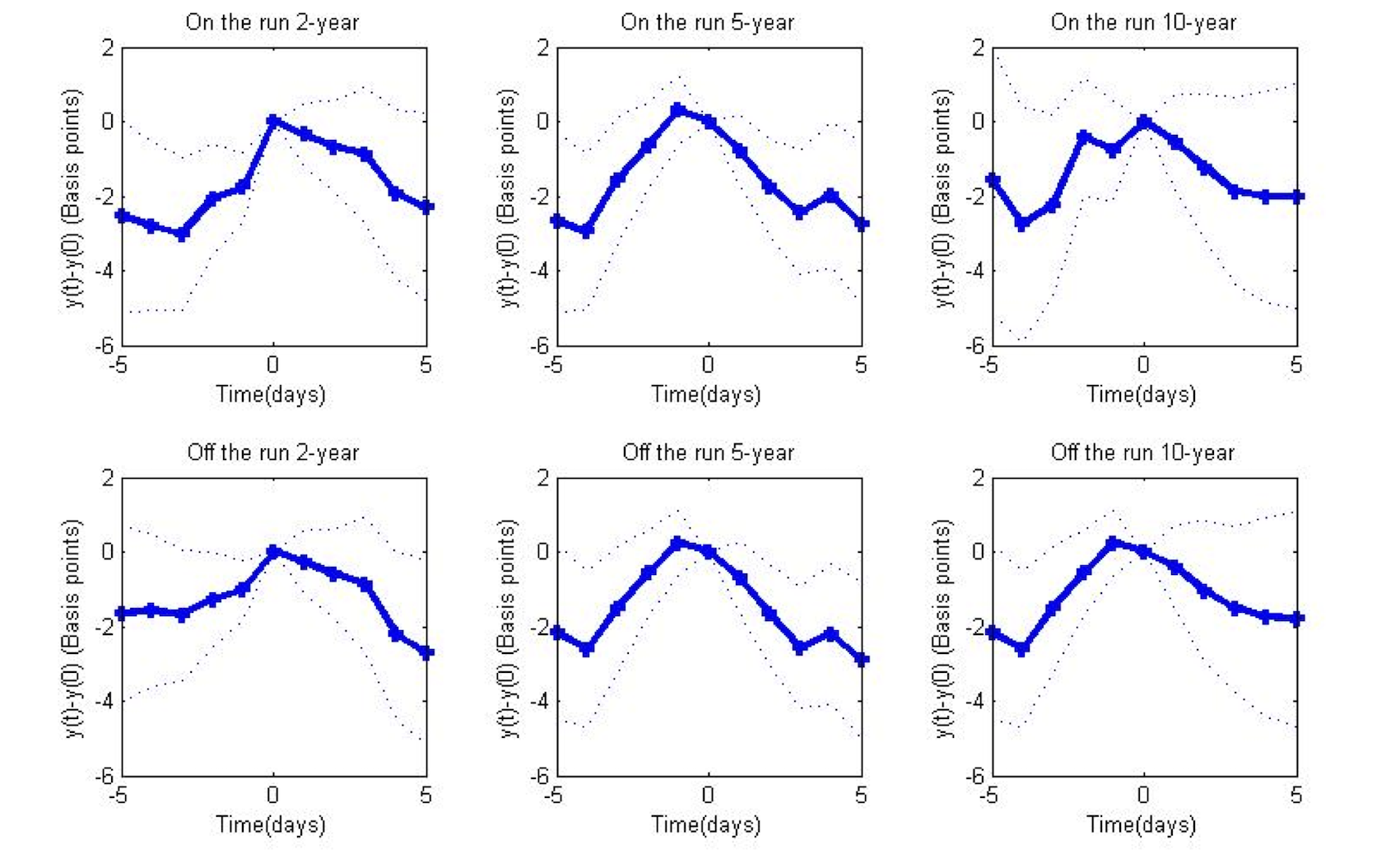

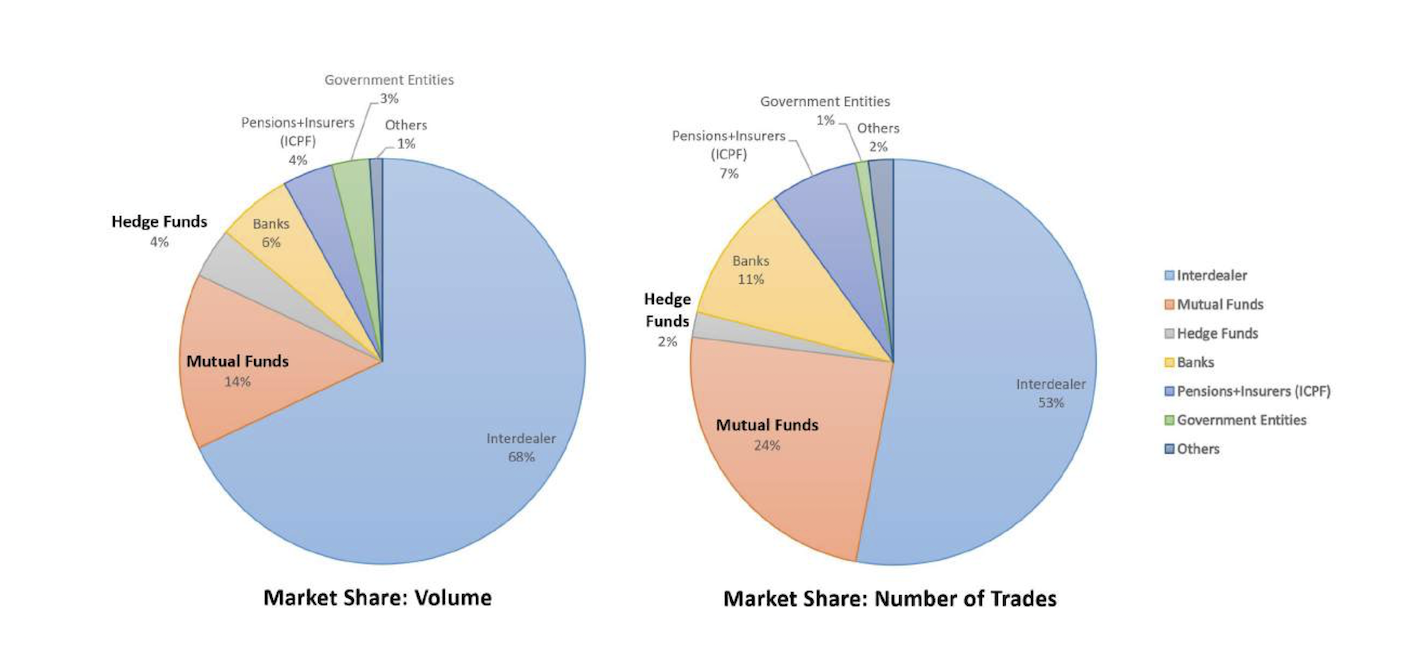

11.Informed Trading in Government Bond Markets (with Robert Czech, Shiyang Huang, and Tianyu Wang),

Journal of Financial Economics, 142, 1253-1274 (Internet Appendix)

Winner of Best Paper Award, China International Conference in Finance, 2019

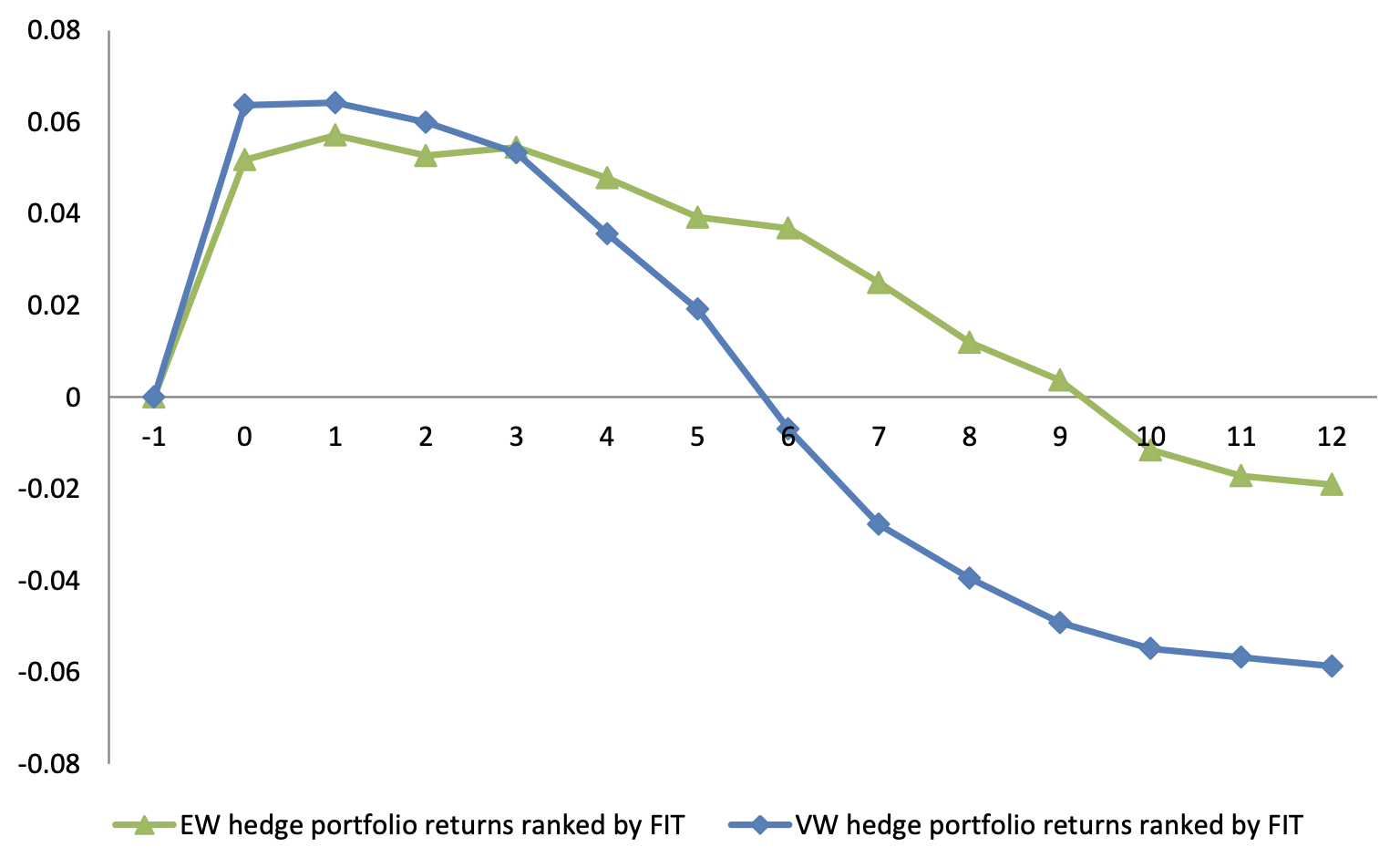

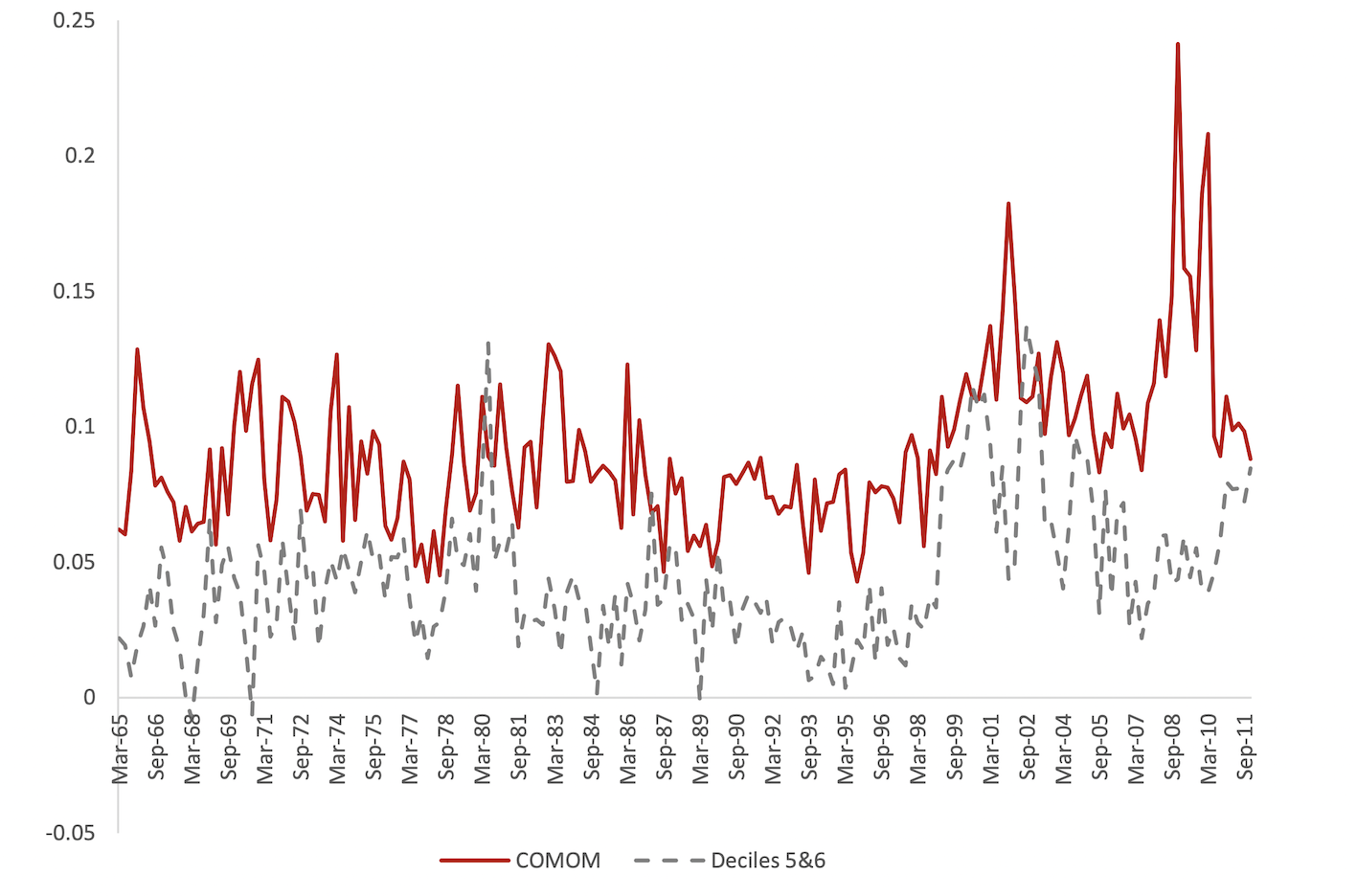

12.Comomentum: Inferring Arbitrage Activity from Return Correlations (with Christopher Polk), 2022

Review of Financial Studies, 35, 3272–3302

Finalist for AQR Insight Award, 2014

Winner of Institute for Quantitative Investment Research (Q Group) Grant, 2012

Winner of Institute for Quantitative Investment Research (INQUIRE Europe) Grant, 2012

13.Ripples into Waves: Trade Networks, Economic Activity, and Asset Prices (with Jeffery Chang, Huancheng Du, and Christopher Polk), 2022

Journal of Financial Economics, 145, 217-238

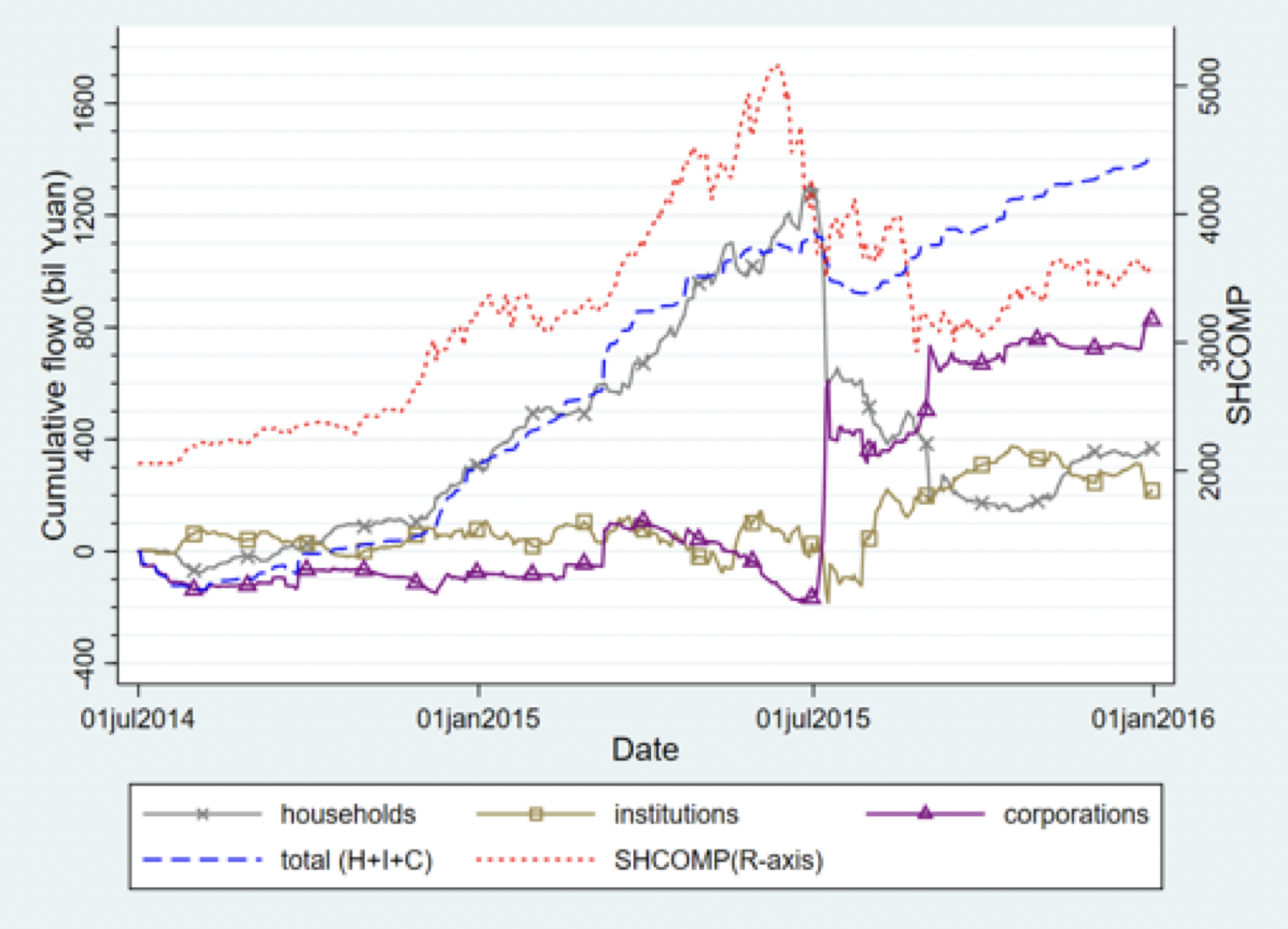

14.Wealth Redistribution in Bubbles and Crashes (with Li An and Donghui Shi), 2022

Journal of Monetary Economics, 126, 134-153

Winner of Best Paper Award, China Financial Research Conference, 2019

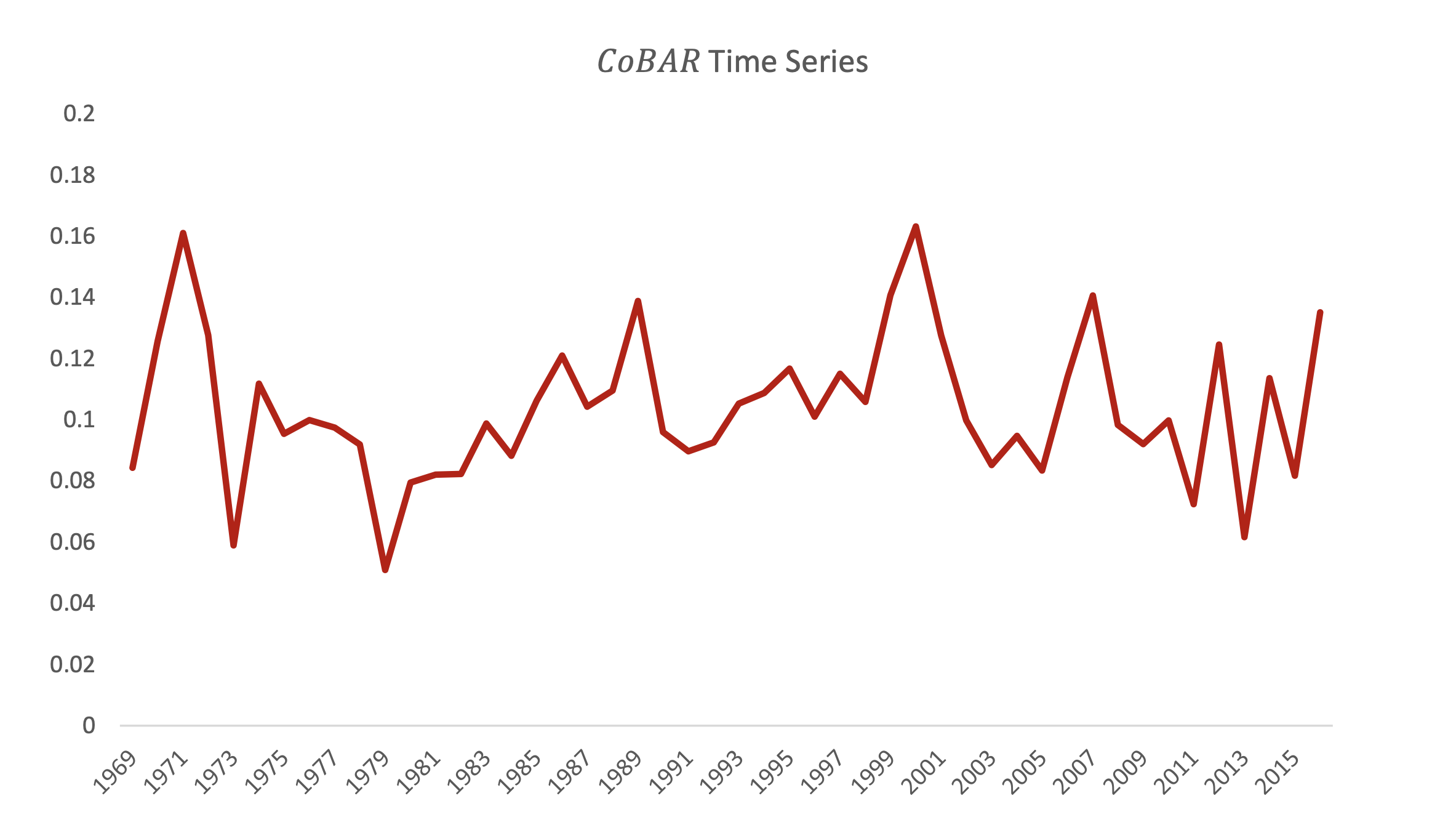

15.The Booms and Busts of Beta Arbitrage (with Shiyang Huang, Xin Liu, and Christopher Polk), 2023

Management Science, forthcoming (Internet Appendix)

Winner of Quantitative Management Initiative (QMI) Grant, 2013

Winner of Europlace Institute of Finance Research Grant, 2013

16.The Drivers and Implications of Retail Margin Trading (with Jiangze Bian, Zhi Da, Zhiguo He, Kelly Shue, and Hao Zhou), 2024

Journal of Finance, forthcoming

Winner of Best Paper Award in Asset Pricing, SFS Cavalcade Asia-Pacific, 2017

Winner of Best Paper Award, China Financial Research Conference, 2016

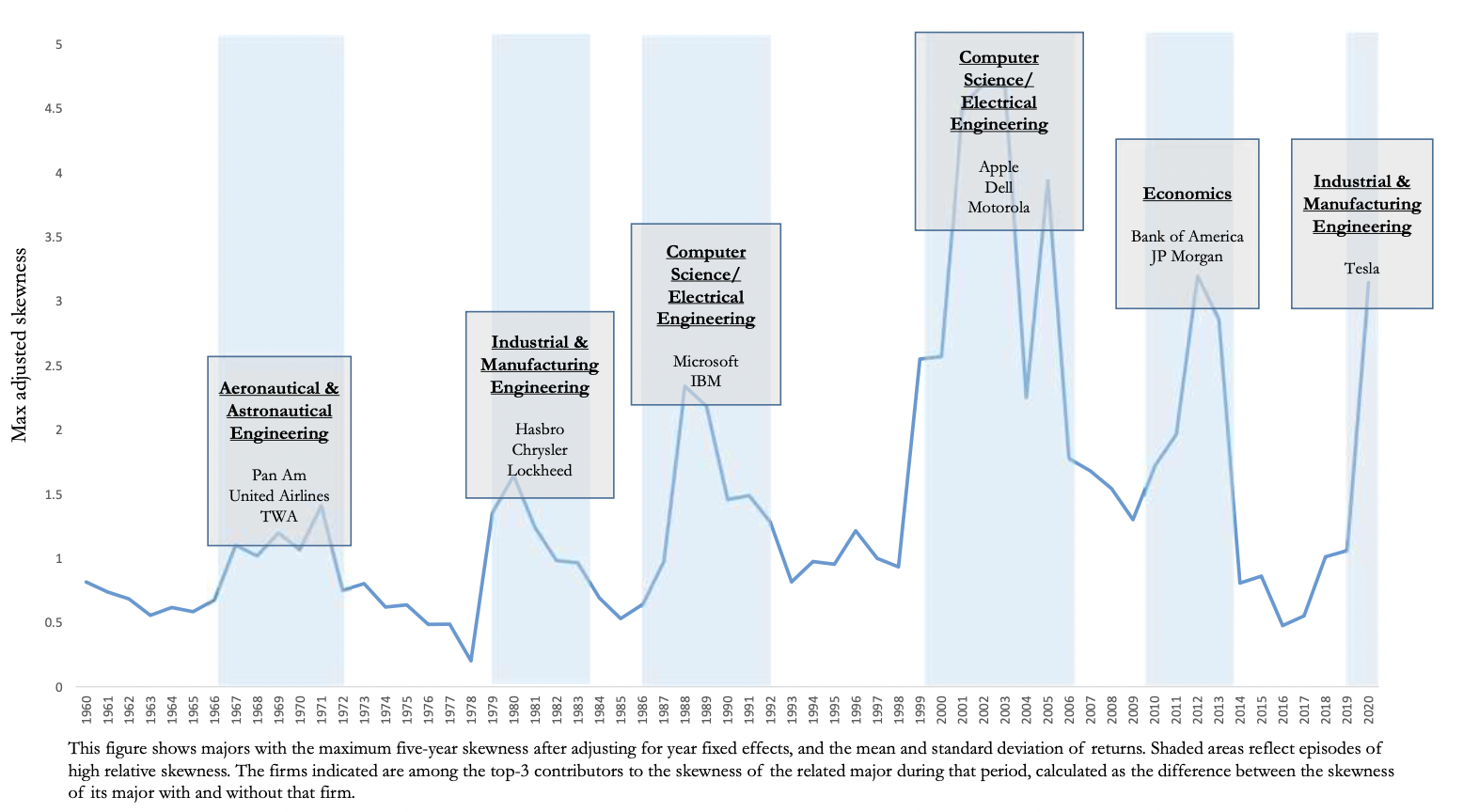

17.Superstar Firms and College Major Choice (with Darwin Choi and Abhiroop Mukherjee), 2024

Journal of Political Economy: Microeconomics, forthcoming

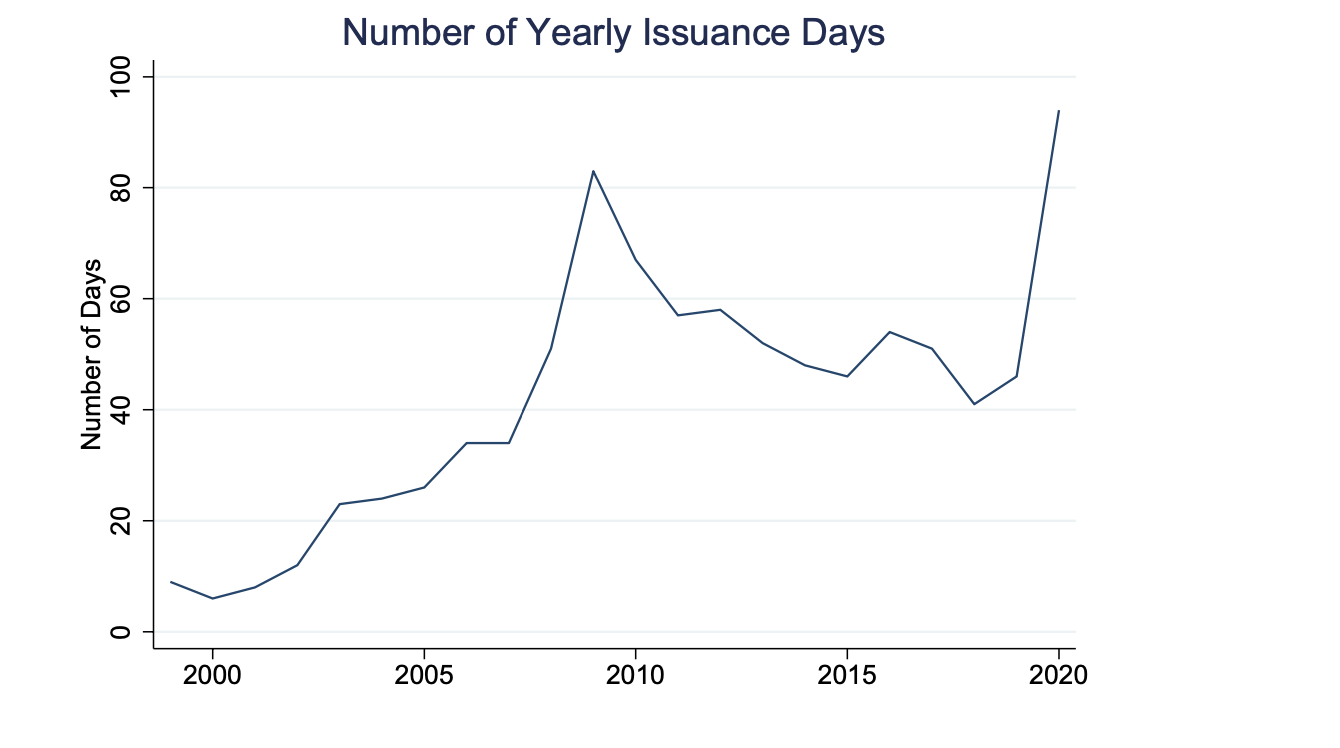

18.Yield Drifts when Issuance Comes before Macro News (with Gabor Pinter, Semih Uslu, and Danny Walker), 2024

Journal of Financial Economics, forthcoming

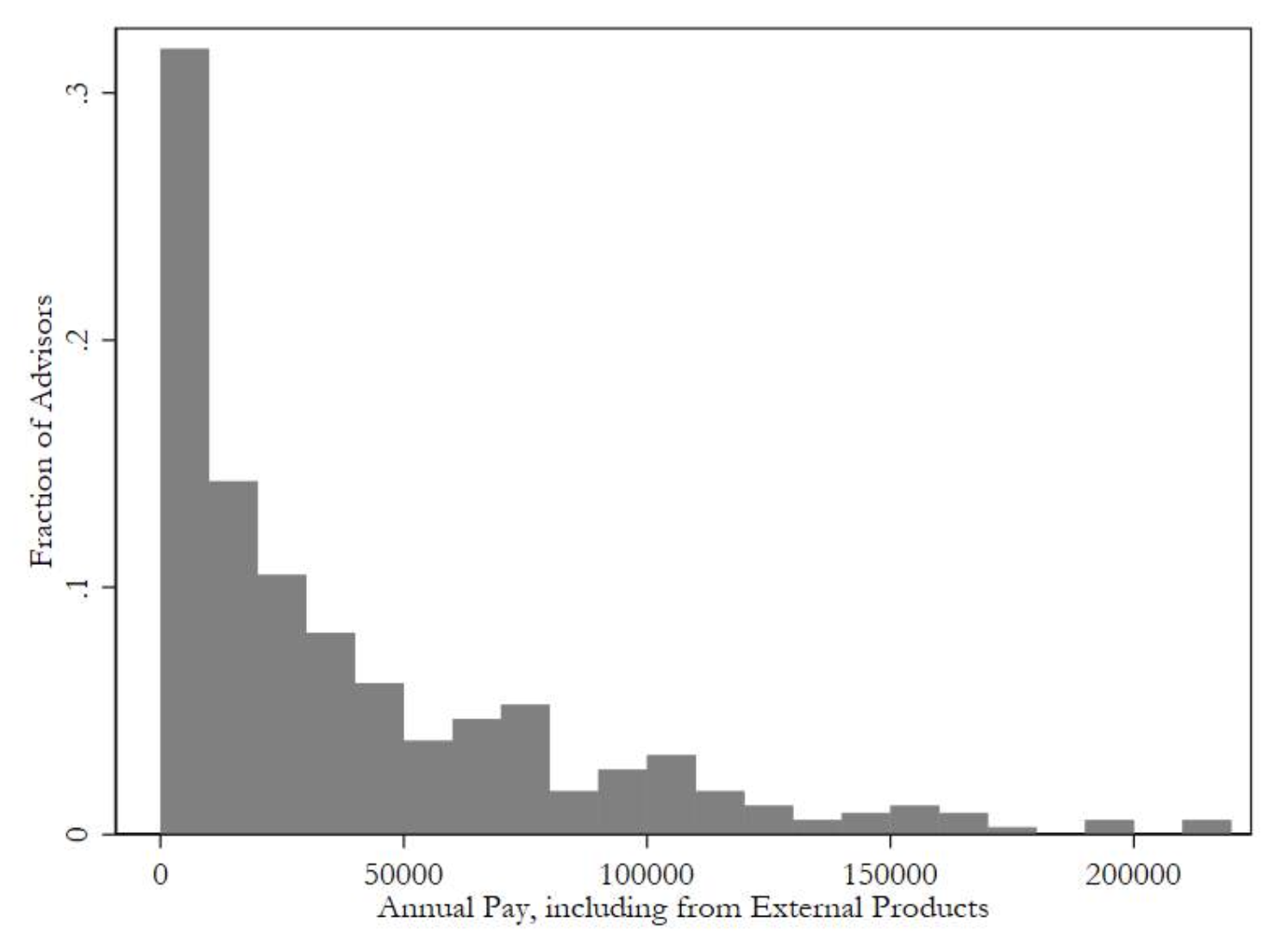

19.The Effect of Advisors’ Incentives on Clients’ Investments (with Diego Battiston, Jordi Blanes-Vidal, and Rafael Hortala-Vallve), 2025

Journal of Finance, forthcoming

closure

closure